Are you a freelancer or blogger looking to work online? Are you the one Looking to receive Payments from Outside your country with Minimal Fees? Do you need the “Best payment gateways for international transactions”? Then Follow the Guide Which Deals with the Best Payment Gateways for Freelancers to Receive their income from any part of the world. Almost every payment Gateway will give you an option to generate the invoice to get paid from your customer via Debit/Credit card or Bank account. So you don’t need any website or blog to receive payment from abroad.

Online Jobs are expanding in no time. The days when we work for our local people are gone. Now one can work any from home and can receive their income directly to the bank. Whether you are a blogger or freelancer, you need to use payment Gateways to receive money from abroad. However, it requires a little setup this must be a needed one especially for freelancers who works online. Everyone may or may not be familiar with the following list, But believe me, it doesn’t take much time to habituate to them for your international payments.

If you are a freelancer, I suggest you any one of the Top Freelancing websites like Fiverr. So that you don’t need to use the payment gateways. Of course, freelancing websites take around 20% of your income. When you want to save those changes, you need to work individually, and you must use any one of these payment gateways to receive money from abroad.

If you are from India, you can Also Read Top Payment Gateways in India.

If you are a freelancer, I suggest you start a blog using our Guide. Because blogging is one of the best ways to earn money online.

What is a Payment Gateway?

It’s a merchant service that authorizes Our Payments and Cards (Including all our Bank Cards)that are processing for online retailers. A payment gateway can be provided by the bank or can be framed by a financial service.

In simple it looks after the payment transaction between the payment portal and the front-end processor. It helps in receiving money from other countries as well as using the money conversion feature.

Even if you don’t have a website, you can generate the invoice for your freelance work using Payment Gateways. And send the invoice to your receiver. They can pay using cards or bank account.

Best payment gateways for international transactions

Video Tutorial:

For the reader’s convenience, we always create a video tutorial. Either you can watch and learn or simply skip the video and continue with the steps mentioned afterward.

Here are the top Gateways which are mostly used by freelancers. One can select the following depending upon their region. I request you to double-check the fee page of that particular website before initiating a transaction.

1.Payoneer

Payoneer is one of the best Best payment gateways for international transactions. It’s a well-known trusted name for Internet Users. However, A Payoneer account is good enough to send and receive money and it was listed here. The main motto of the gateway was to make the withdrawal more simple than others and was quite successful. There are a number of withdrawal options(Payoneer card is one of them and we can use it at ATM’s too)including local bank accounts as well.

Why we like the most is, its charges are very less compared to other payment gateways. They will give you a local bank account in the US, Europe, Japan, China, UK, etc. So you can receive direct deposit payments from those countries.

The disadvantages of the gateway are we can’t integrate with a plugin on E-commerce WordPress websites. It is not as popular as other payment gateways. Most of the merchants do not support it because It is not as convenient as PayPal to send and receive money.

I Suggest, whenever you want to receive the payment from abroad, first try with Payoneer. When the sender cannot send then only go with PayPal or any other. It saves you a lot of money.

Marketplace Supported:

These are some major companies where you get paid in your Payoneer account and you can later transfer it to your local bank account with very minimal charges:

- Freelancers and Service Providers: Fiverr, Adobe, Upwork, OneHourTranslation, Shutterstock, GettyImages, Crossover, Welocalize, etc.

- E-Commerce Marketplace Sellers: ebay, Amazon, Shopee, Cdiscount, Wish, Lazada, Rakuten, Tophatter, etc.

- Digital Marketing and Beyond: Google, Airbnb, Taboola, Commission Junction, Homeaway, Tradedoubler, etc.

Popular Currencies Supported:

- USD, EUR, GBP, JPY, AUD, CAD, MXN, and much more

Payoneer International Fees (2021 Updated):

Getting Paid:

- Recieve payments from others who pay from their Payoneer balance: Free

- When clients pay you from their credit cards: 3% (all currencies)

- When clients pay you via ACH bank debit (US Only): 1%

- Getting paid from marketplaces: Fees depend on the marketplace itself

Withdrawl (Bank Transfer):

Withdrawal charges may vary if you are transferring money from Payoneer to a local bank account of the same currency or another currency. See these are the charges. One more thing, regardless of the currency type there might be an additional fee charged by your local bank.

- To a local bank account of the same currency

- USD to USD withdrawl: $1.50

- EUR to EUR withdrawl: C$:1.50

- GBP to GBP withdrawl: €1.50

- To a local bank account of the different currency:

- Upto 2% (Rates may vary depend on the market place at the time of transaction)

Important Note: Additional charges may apply by your bank (bank processing fees, landing fees, etc)

Paying Fees to someone:

- ACH bank debit (USA only): 1%

- Credit card: 3%

- Local bank transfer: 1%

Payoneer Transfer Time:

- 0-3 days (faster than PayPal)

Payoneer Availability:

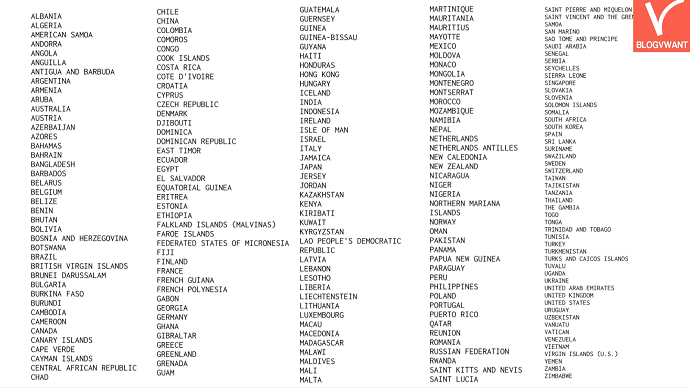

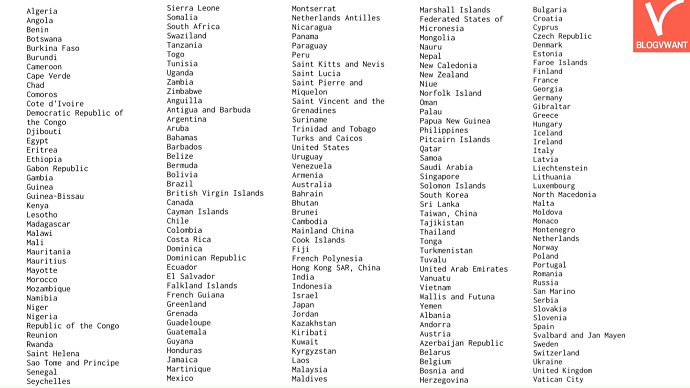

This is the 200+ countries list where Payoneer is available.

If you make $1000 transactions after you signup, you will get a $25 bonus.

2.Paypal

Paypal is the leading Payment Gateway for a number of Online Businesses and it works for freelancers as well. You can receive the payment just with your Email id. You can also generate the invoice to receive payment from your customer. Paypal Might be a great choice as it was trusted by more than 180+ Million people. Forgot about PayPal, Try Paypal pro to enjoy the maximum of this gateway which costs 30$ per month excluding the transaction fee. PayPal also gives you the option to create both a business account and an individual account.

Having a merchant Merchant account benefits, as money will be credited to the linked bank account and it is not at all mandatory.

Its UI is more comfortable to accept 25+ currencies from all credit cards. Only because of its fees, we have given number 2 in the list otherwise it would have been the number one in the list.

PayPal Currencies Supported:

USD, AUD, BRL, CAD, CNY, EUR, CZK, DKK, HKD, HUF, ILS, JPY, MYR, MXN, TWD, NZD, NOK, PHP, PLN, GBP, RUB, SGD, SEK, CHF, THB.

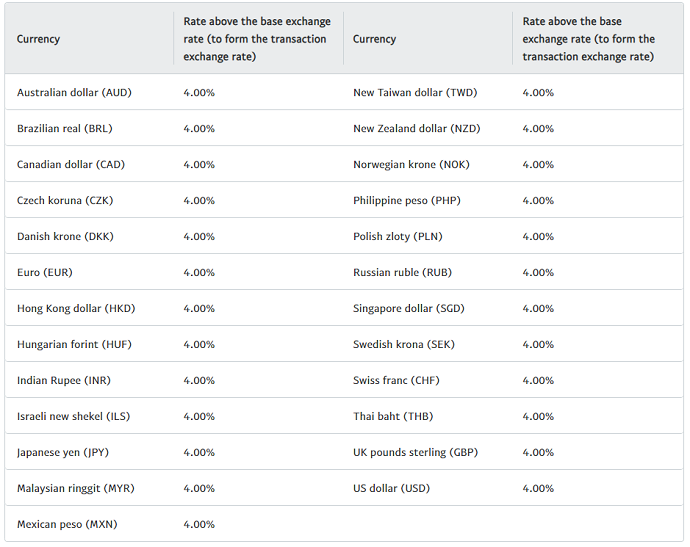

PayPal International Payment Gateway Fees:

When we talk about Paypal international charges you only need to pay when currency conversion is involved in transactions. This again depends on the currency and the location of the receiver.

For India, A general charge is 3% for converting balance and payments received into another currency. However, consider this rate table for all other currency conversions. Also, there might be an additional charge involved in withdrawls made by your bank.

Note: When you open up the PayPal fees webpage, it will automatically by default shows the percentage of the fees according to your country.

PayPal Transfer Time:

- 1-2 days (slower than Payoneer)

PayPal Availability:

Note: We advise you: First signup to PayPal and check your international currency charges. If it is more than you expected, then switch to Payoneer or other international payment services.

- Related: Top 6 Alternatives For Paypal

3.Stripe

Stripe is a banking company. Stripe is a US-based technology company that allows business organizations and individuals to receive money on the internet from various locations. It initially provides fraud protection and banking system service for all your online payment done through it.

Stripe is mainly known for its powerful API which web developers can use to integrate payment processing systems into their websites and mobile applications. Stripe is available only in 35 countries but supported 135+ currencies which are more than PayPal. Apart from that Stripe supports lots of payment options including credit/debit cards, major wallets, wire transfers, buy now pay later, cash-based vouchers, and many more.

One can incorporate their company with Stripe using its atlas program which initially opens a bank account for you. The best part is it was accepted on all popular shopping platforms without a setup fee and monthly fee. However, stripe charges some fee on the transaction depending upon the amount. Bitcoins can also be accepted at Stripe payment processors.

Go for the stripe when you want to integrate the best secure and powerful payment processing system into your website and apps.

Stripe International Fees

When we talk about Stripe fees, you will be glad to know that with stripe there are no hidden charges involved compared to PayPal or Payoneer. Stripe is going to charge you a fixed percentage for international payments. The price details for major countries are listed below:

USA:

- Cards and Wallets: 2.9% + $0.30. Plus 1% for international cards. Plus 1% for currency conversions.

- In-Person payments: 2.7% + $0.05. Plus 1% for international cards. Plus 1% for currency conversions.

- ACH Credit payments: $1 per payment.

- Wire payments: $8 per payment.

Canada:

- Cards and Wallets: 2.9% + C$0.30. Plus 0.6% for international cards. Plus 2% for currency conversions.

India:

- Cards: 4.3% for international cards + 2% for currency conversion.

UK:

- Cards and Wallets: 2.9% + 20p. Plus 2% for international cards. Plus 2% for currency conversions.

Stripe Availability:

And these are the 46 countries where the stripe is available for businesses. However, Stripe can accept payments from anywhere in the world.

Stripe Transfer Time:

Stripe supports automated payouts. However, you can also request for manual transfer. The automated payouts time for some of the major countries is this:

- 2 Business Days: Australia, United States

- 4 Business Days: Indonesia and Newzealand

- 5 Business Days: India, Malaysia, United Arab Emirates

- 30 Business Days: Brazil

- Weekly: Japan

- 3 Business Days: Europe and Canada

4.Wise (TransferWise)

Wise formerly known as Transferwise active for the last 10 years and has gained more than 10 million customers. It was founded by the People who backed Skype. Most of us might be aware of this payment. I bet most of the freelancers use this for its low transaction fee which is better than PayPal and all. Moreover, you never lose much money over money conversion.

People prefer wise because of its crystal clear fees calculator, low-cost exchange rates, and fees. Where other financial companies make a profit of 3-7% on exchange rates, Wise only makes 0.5% which is very low. The only cons of this payment gateway are the availability and lack of supported payment options. For example in India, you can only send money via bank transfer. Also not every popular marketplace supported Wise.com.

Money conversion will be done as per your requirements with a minimal fee. It accepts a number of countries and currencies as well.

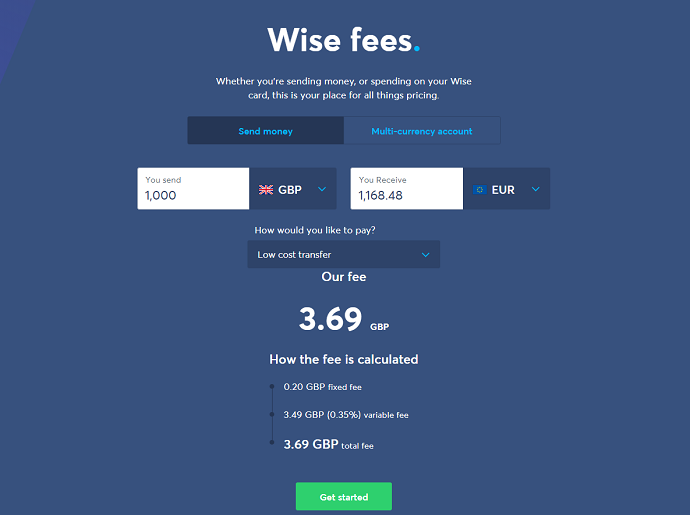

Wise International Fees:

When we talk about Wise.com fees, it is very low. To calculate the fees just open up any webpage of wise.com and use this fees calculator widget. No hidden charges are involved. This is the main advantage of wise.com.

Wise Availability:

These are the countries where you can send money from Wise.com

Wise Transfer Time:

Wise offers 3 transfer modes: Fast advanced and low cost. So transfer time is varied in each transfer mode. According to the customer reviews, we found that Wise.com takes a lot of time and this is a kind of disadvantage.

- Fast Transfer Mode: Instantly.

- Low Cost Transfer Mode: 4 business days.

- Advanced Transfer Mode: 2-5 business days.

5.2Checkout

2checkout is also similar to stripe but not that powerful. 2Checkout provides companies tools like API to integrate payment processing systems into their website and mobile apps. The best thing is that it has 120+ supported integrations for the most popular shopping carts and invoicing systems. Further, it covers 200+ countries supports 45+ payment methods and more than 100 currencies. As Said, It works well in the countries where Paypal and Stripe are out of service.

Along with Easy User Interface, it provides a number of options for withdrawal as well. One can integrate any card including a Payoneer card to withdraw amounts from the wallet.

2Checkout International Fees

When we talk about 2checkout pricing, they have 3 pricing plans. The good thing is that they cannot charges based on the transaction amount. Instead, they set up fixed transaction charge the user has to pay according to its plan. For international transactions where currency conversion is required, an additional 2% fee will be applied. Compared to the Stripe international payment charges, 2Checkout fees charges more

You need a merchant 2checkout account to receive payments.

6.Authorize.net

Authorize.net is a US Based Payment Gateway Service that accepts Credit cards and all through an Internet Connection. There are many features regarding this merchant and some of them are

- It Accepts International Customers.

- It offers Fraud Protection services for free.

- Merchants are able to store the sensitive details using customers information manager.

- It Doesn’t offer a shopping cart for itself.

Despite many features, It only accepts all if your location is based in the United States of America, UK, Europe, and Australia. To need to get paid at any international location one needs to contact Cyberscore which the part of its parent company.

Authorize.net International Fees

When we talk about authorize.net pricing two pricing modes are available: Payment Gateway only and Payment Gateway + Merchant Account. It is good if you have a merchant account for your business otherwise fees will go rise. And remember for international transactions, there is additional 1.5% fees per transaction is included.

- You Might Like: 5 Best Free online web development courses

Conclusion

Hope you had got and everything clear about the Best payment gateways for international transactions for receiving payments from other countries.

I would suggest PayPal or Payoneer as a preferred option when you want to transfer money internationally to your clients in a minimum possible time. And Stripe is the recommended one when you want to integrate a payment gateway to your website or app for accepting global payments.

Sometimes all cards may not be accepted to withdraw or send the amounts which are in these wallets. Make sure to add your primary bank accounts before starting the actual Transaction and this helps. If you like this article, please share it. If you know of any other payment gateway, please share through the comment section. Follow BlogVwant on Facebook, Twitter, and YouTube for more information.

Very Informative article. However, I guess stripe is the best in terms of fast settlement days. As many big ecommerce companies are using this payment gateway. India’s leading mobile insurance company TIMES Global Assurance is also using stripe for its global customers to accept payment internationally.

Amongst all e-wallets on offer, PayPal is probably the best go-to payment method due to the fact that it is extremely secure, and there are various sites that allows you to make payments via your PayPal account. Along, with that there are various arcade games online at casinos that also accept payment via PayPal.

really nice article and interesting conclusions. In my personal opinion also very good ist g2a pay they support over 200 payment methods and are pointless, maybe it will be a good solution for business.